Introduction

The intersection of gaming and crypto has been highly anticipated. Gamers have a natural understanding and appreciation of ownership of digital assets which is what technological breakthroughs like NFTs and cryptocurrencies are aiming to facilitate.

With high expectations to find product-market fit for blockchain technology and bring mass adoption via over 3bn gamers around the world, NFT gaming has found its first killer application in 2021 when Axie Infinity became the largest crypto application in terms of users and revenues generated.

With the play-to-earn model, Axie’s developer Sky Mavis introduced a new paradigm to gaming as a potential Web3 replacement for free-to-play games, followed by YGG pioneering the scholarship model, incentivizing thousands of guilds to follow suit and enter the NFT gaming space with an abundance of capital.

But now, after the initial euphoria around Web3 games has diminished, apparent issues cropped up around the economic sustainability of P2E games like Axie Infinity and the clear discrepancies between what guilds were set out to do (guilds bring early player liquidity to promising games) vs. how the dynamic between new games and guilds have actually evolved (games with unsustainable tokenomics often hand out assets to guilds and influencers at large discounts to attract retail).

Many early adopters of Axie and the guild model have made immense, unheard-of gains and the open economies of NFT games have attracted large amounts of investors looking to be early in the next Axie before the highly anticipated “GameFi summer” which could bring many 100x-ers.

The truth is that in this early stage of crypto gaming, most Web3 narratives diverge significantly from the current reality and there are high risks for the alpha-less & those “late” in this game.

Therefore, the goal of this blog is to cover:

Games & Economies: explaining game economies and why they are critical to navigating this complex environment

Game Economies & NFTs: creating transparency around the status quo of NFT game economies

Sustainable, Open Game Economies: deriving success factors for players/investors, collectors, game developers, guild managers, scholars, investors/VCs, and other players

Eventually, more players will be able to see through the high-level dynamics of the space and make better decisions for their entertainment and financial life, driving forward the true innovation that open NFT game economies can bring.

All in line with the motto “If you can’t explain the game economy, you are the game economy”, we’ll start right at the crux of the topic at hand.

1) Games & Economies

Why speak about economics when all I want to do is play a fun game, you might ask?

At their core, most games have always been built on elements of economics where players are strategically competing for resources according to the rules of the game.

Balancing the scarcity and velocity of these resources in a game economy is as critical to the success of a game as the primary goal to attract player demand for the game in the first place.

In game economies, assets are minted via rewards for in-game activities & achievements (supply/faucets) and assets are burned via spending for in-game consumption (demand/sinks). The balance of demand and supply determines the price of the assets the game economy.

While most of us would not consider ourselves economists when we enter a game, we are all naturally putting our game economist hat on to evaluate whether a game is fun, fair, difficult, and rewarding.

This assessment is based on our own valuation of the time and effort we put into a game (economic inputs) measured against the achievements according to the rules of the game (economic outputs). If the game economy is balanced and the math works out, we consider it “fun”, if it is not, we won’t be motivated to play.

For game developers, creating a balanced game economy has been critical to building a popular game and creating a sustainable business around it. While monetization models have developed from pay-to-play to free-to-play, virtual game economies have become more complex with real money and marketplaces.

Developing free-to-play games that remain sustainable and profitable is difficult which is why game economy designers have become high-demand positions. To reduce the complexity as well as combat abuse of free-to-play economies, most between-player resource exchanges had to be eliminated. This allowed game economy designers to focus on an individual player’s progression and in-game purchases.

The two most important aspects of a sustainable game economy are

players have to remain motivated to play

the game’s revenue must cover continued game development support

The game needs to feel relatively fair while encouraging players to spend money, with the note that some games and genres tolerate more advantages for those who pay than others.

2) Game Economies & NFTs

Web3 has entered the chat - wyd?

Most blockchain-based games have economies with NFTs and/or tokens built around a core gameplay loop.

Blockchains are open technology standards that bring open economies to games. In this context, “open” refers to ownership and the ability to take property (NFTs and/or tokens) out of a game and bring them into other markets.

The Web3 narrative is that blockchain technology brings an array of benefits to all stakeholders through open economies.

But what’s the success to date? Let’s dive deeper.

Ownership & open economies bring opportunities for players...

NFTs allow players, as opposed to just game developers, to own in-game items (like pets or characters) as value represented on open blockchain networks, while allowing game developers to fund game development upfront and earn on secondary sales.

We haven’t seen many interoperability use cases for items that “you can take with you to another game” but we are observing first attempts. Players can sell in-game items and take the value to another game which is a basic level of interoperability that has technically or legally not been possible before.

Utility tokens allow game developers to reward players for participation or achievements in their game in the form of cryptocurrencies which can be converted to other currencies globally, 24/7.

This concept only works in theory, under certain conditions. In practice, we haven’t seen any proven play-to-earn tokenomics models yet which reward players in a sustainable way, as we will explain later.

Ecosystem tokens allow stakeholders, like game developers, players or guilds, to align incentives, have a share in the game, and participate in governance, effectively deciding on the future direction of the game even at an early stage.

In practice, we haven’t seen large developers like Axie’s Sky Mavis actually implementing decentralized governance on key decisions like marketplace fees or expanding/contracting inflation yet. There is a separate discussion on whether democratizing decision-making in game development is actually desirable, looking at recent outcomes of collective decisions in democracies. Players may also not make the best long-term decisions for a game. Most ecosystem tokens are currently also being used as in-game utility tokens, for example, breeding in Axie, buying items in Splinterlands, minting NFTs in Gods Unchained, etc.)

... but also great responsibilities for game developers

So much for the potential benefits of Web3 and the status quo. But what about the risks?

In addition to investing their time, players can now invest their money and become owners of NFTs and tokens of a game. This means they also own the underlying risks and responsibilities that come with those actions.

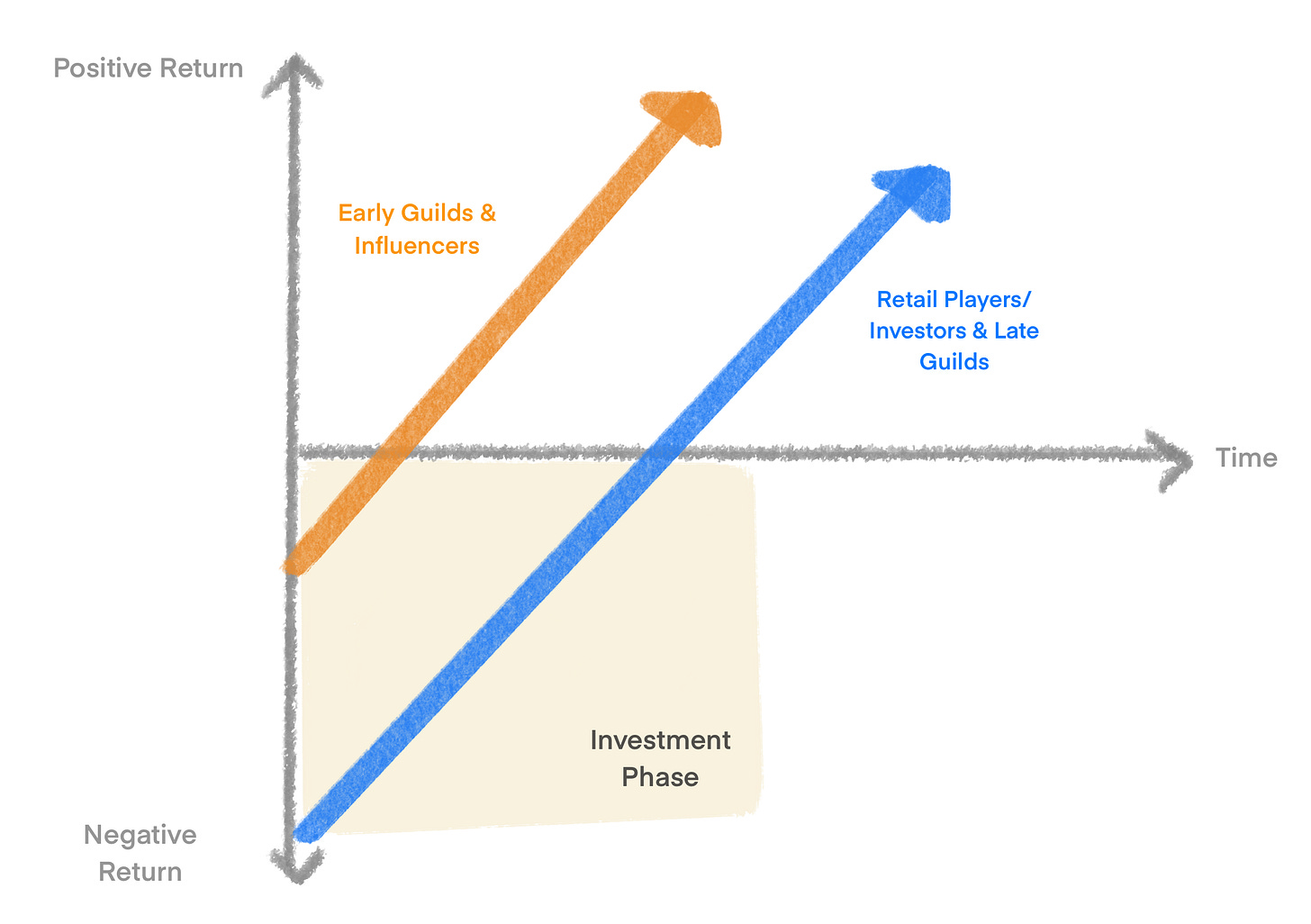

All game economies & tokenomics designs in the nascent NFT-gaming space are still economic experiments that have brought about massive gains for early adopters but also extreme losses for players/investors that have entered unsustainable game economies at a later stage.

The financialization of games has introduced reflexivity which means players come as prices rise but they are fast to exit as prices go down, leading to extreme downward spirals and losses for bag-holders with often illiquid NFT supply.

An apparent shortcoming of the current state of NFT gaming is that there is too much focus on the potential benefits of blockchain-enabled games but not enough transparency on the unsustainability of most game economies. There is also increased risks for retail investor classes arising from new game launches with unsustainable game economy designs.

NFT games tend to launch earlier than usual in order to crowdfund game development and iteratively ship new gameplay features based on feedback from the early community.

The issue is that these lightweight versions of most games

do not have sufficiently entertaining gameplay to attract pure players that bring sustainable value

lack proper token burning mechanisms required for sustainable game economies and token prices

grant heavy discounts on NFTs and tokens to established gaming guilds, VCs and influencers with a large following

This dynamic particularly increases the risk for one class of actors that does not have access to insider information or to heavily-discounted pre-sale deals with games:

retail players/investors (player/investors are players that invest in the game financially via NFTs & governance tokens and/or with their time via earning reward tokens like SLP)

late-guilds (smaller guilds)

These actors interpret investments by large guilds, VCs and influencers as signal/validation and buy into often unsustainable game assets with unproven demand at a much later and riskier stage with significantly longer ROI durations.

This is where we need to be clear about the current state of NFT gaming: It is great that NFTs and tokens finally allow players/investors and guilds to have ownership over a game’s assets.

But if the majority of games are based on unsustainable token economics and are handing out assets to guilds and influencers at huge discounts compared to retail, then this new system has not opened up new, beneficial opportunities for players/investors but rather brought about significant risks and potential losses.

In the current form, early game launches with unsustainable economies via NFTs and tokens have created a highly risky game of musical chairs about who becomes exit liquidity.

If the ambition is to introduce billions of gamers to crypto and NFTs, then their first experience should not be to get rekt by rushed game launches with unsustainable tokenomics that benefit only a handful of insiders.

As players can now become early investors & owners in a game - carrying both the upsides and risks of ownership - game developers have increased responsibility to create sustainable game economies of value while being transparent about risks.

This is no easy task, as this means navigating the development of gameplay and game economy between a dynamic set of varying interests of stakeholders with whom the game developers hold social contracts and fiduciary obligations.

We tend to say: “show me the incentive, I’ll show you the outcome”.

Now think about how manipulating the economic incentives of open games determines who a game attracts and who it benefits: pure players, investors, grinders, collectors, speculators, guilds, or external stakeholders?

💡 Takeaway: Now that game economies are open, playing a game comes with risks. It’s up to the game developers to drive sustainability and value creation for all stakeholders to move from musical chairs to a new paradigm.

3) Sustainable, Open Game Economies

Why have open game economies failed so far and what is the way forward to success?

Most play-to-earn games to date have been financed by the inflow of new players which has proven to be unsustainable as the dual token system collapses once new player demand & growth slows and players/investors mostly sell the tokens once they have earned them.

There are countless examples of unsustainable game economies which have collapsed and have failed the participants in the ecosystems that had asymmetric information and bought in too late.

As a general rule in the long run, sustainable economies cannot pay out more value in rewards to players than the value that is brought into the game from players and external parties.

Therefore, for open game economies to be sustainable,

there must be pure demand for the game’s entertainment component from players and external stakeholders which is not tied solely to earning expectations

the game must be able to monetize this demand in the form of in-game spending on deflationary burning mechanisms (sinks) that retain value in the ecosystem and remove assets from the economy

the production of game asset supply (faucets) must scale sustainably alongside increased demand for deflationary sinks to maintain desired price levels

Start with demand…

The single most important factor for a game’s long-term success is its ability to attract and monetize pure player demand.

Create pure player demand

One way to think about the demand of pure players is to assess whether a given game would still have demand, which is monetized through in-game purchases, regardless of whether you took away the earnings potential and made it a free-to-play game.

Game economies need to be built on pure player demand for the core value proposition and game loop in order to be sustainable. It is critical that the demand is mainly coming from players/investors & collectors that play the game for fun and entertainment rather than to extract value.

If the majority of players/investors and guilds are playing the game in expectation of earnings, the demand is highly elastic and will swiftly migrate to new yield-farm games with higher earnings potential as the incentives for early entrants in these ponzi-type game economies attract speculators and ROI-chasers.

Monetizing pure player demand for utility

The most important factor for sustainable game economies is that this pure player demand can be monetized so value can remain in the ecosystem and the proceeds can be used to reduce the overall token supply.

The game economy will not be sustainable if players, investors, and guilds don’t retain value in the ecosystem but rather sell reward tokens they earn (extracting value) or only spend them on inflationary sinks in expectation of future ROI (e.g. Axie breeding burns reward tokens short term but creates an “inflationary sink asset” that produces the reward token SLP indefinitely).

The monetization demand can be measured by how much players decide not to sell a game’s utility token but rather spend it on sinks like cosmetics, boosts, unlocks, subscriptions, upgrades, tournaments with token buy-ins), repairs, etc.

The main motivation to spend in-game has to come from pleasure, status and other reasons rather than to increase future ROI. In the end, games need to provide real utility and meaning to people which is reflected in the players’ desire to contribute value to the ecosystem.

If the game’s main utility stems solely from providing earnings rather than providing meaning for players (non-earnings-related utility), there is no incentive for players to keep value in the game by spending money on desirable sinks (leaving aside that these kinds of sinks are not even offered yet in most NFT games).

Monetizing demand from external stakeholders

Eventually, value can also flow into the game economy from external stakeholders via earnings from advertisements, sponsorships, and selling anonymised player data. It will be key for games to attract the right partners for this income stream and recycle the revenues into the game economy in a way that contributes value to (and aligns with the incentives of) all stakeholders in the ecosystem.

The monetization demand from external stakeholders can be measured via the number of external partnerships a game has established and the path to monetization for these partnerships.

This is where NFT games have the potential to create more sustainable business models than free-to-play where creativity has been squeezed by low margins due to low retention rates and high customer acquisition costs paid to Web2 gatekeepers.

NFT games with high earnings potential and strong communities could increase retention and reduce the need for high spending on customer acquisition and growth as existing players can be better monetized in theory.

While NFT games show a lot of potential improvements over direct monetization of external stakeholder demand, there are no successful examples of this yet and it remains to be seen whether this model can be executed effectively. Note that this value stream usually requires large scale to have a significant impact on game economies.

…then manage the supply

It is critical that the demand for deflationary sinks always scales alongside increased asset supply production.

Therefore, the main challenge for NFT game developers remains to build games that attract & retain value (monetized demand) while controlling the asset supply through proper game economy design.

As with any economy based on resource scarcity, it is essential that the supply of core resources cannot easily be inflated in times of rising demand and rising prices. In order to plan and maintain sustainable tokenomics, game economists need to closely monitor and actively control (centrally or by code) supply production (faucets) and destruction (sinks) of in-game NFTs and reward tokens. The key is to make sure the supply scales sustainably alongside the increase in demand for deflationary token burns, maintaining the desired price levels and real earnings potential of the economy.

The equation for sustainable game economies remains that the value of the rewards paid out to players cannot be higher than the earnings (and initial customer acquisition budget) of the game developer.

When games face significant growth of players who are all guaranteed to be paid out of the same rewards pool, the price of the rewards token has to inevitably go down.

In order to maintain sustainable tokenomics in times of growth, games need to either

increase their revenues/earnings at the same pace as user growth via in-game spending on sinks

limit reward token payouts by introducing selective measures

cap earnings ability of ROI-NFTs (NFTs that allow players/investors to produce reward tokens)

1) Increased earnings will be harder to achieve in the short term before the game gains significant traction, has advanced gameplay, and attracts a player base that spends money in the game.

It is important to note that increased earnings must not be driven by revenues from selling ROI-NFTs that

only reduce the reward token supply in the short term (by burning finite amounts of the reward token)

significantly inflate the reward token supply in the long-term (by paying out infinite amounts of reward tokens to NFT holders).

Plenty of examples like Axie and Pegaxy have shown that increasing earnings solely through this mechanism is not sustainable in the long term as the model depends on infinite growth, however, that very growth is the cause of inflation (the more players, the higher the reward token production).

2) Limited, selective reward token earnings are therefore significantly more important to be in place at the time of launch in order to ensure the sustainability of an open game economy.

It is simply not feasible to continuously and indefinitely pay out rewards to all players in a game economy, regardless of whether the players are contributing value to the game (playing for fun and spending tokens in the game) or they are extracting value (grinding to earn and selling the token).

One approach to solve this challenge is to introduce game mechanics which can serve different player classes that engage with the game somewhere on the spectrum from grinding for earnings to paying for value while ensuring both contribute value to the game.

For example, scholars could grind to produce some kind of IAP-style boosters that they sell to paying players/whales, similar to how crafting can provide part of the economy in MMOs. The boosters are tedious to grind time-wise which makes them valuable to the paying players but are consumable so they don't produce indefinite value like breeding for SLP does.

Alternatively, payouts can be limited by only rewarding skilled players and/or introducing mechanics where some players can lose money as well, whether that is daily or in tournaments where the non-winning participants lose their buy-in paid in tokens as an example.

3) Controlled issuance of NFTs that grant reward token earnings (ROI-NFTs) is one of the key factors in ensuring the long-term sustainability of NFT-based game economies.

In order to keep new user growth in balance with the rewards available in the earnings pool, game developers need to enforce controls on the new issuance (e.g. limited NFT drops like in ICE Poker) and new production (e.g. high cost and other limitations on breeding) of ROI-NFTs that allow players/investors to produce reward tokens.

Another way to control long-term inflation of the rewards token is to introduce durability on the earnings of ROI-NFTs via seasons, perma-death, or NFT-sinks, as reward token payouts must not be guaranteed to be paid out indefinitely.

Takeaways

To conclude, there is a vast amount of ways for game economists to manage inflation by controlling the supply of game NFTs and reward tokens. It is important to note though that besides solving inflation, artificial scarcity comes with a new set of issues like heavy wealth inequalities and others.

More importantly, though, the focus has to shift from fixating on artificial scarcity to obsessing over reasons to attract players & other stakeholders and get them to contribute more value to the game.

Way Forward

Through open game economies, developers will be able to run an infinite amount of monetary experiments with new game launches, building on the successes and failings of previous projects, similar to the sheer amount of monetary experiments we’ve seen in DeFi.

The majority of these experiments will fail unfortunately, however, the successful game economies that will emerge out of this experimentation phase will be antifragile as a result of shocks, volatility, attacks, and competition.

It is important to note that this open game economy experimentation will have real-world, financial consequences for all participants which is why we need to create transparent frameworks to drive sustainable game economies.

Leaving aside whether open game economies have been unsustainable so far as a result of genuine experimentation or intentional money grabs, they have led to many players, investors and guilds losing on their game-NFT investments which is why transparency and open debate needs to be promoted.

Game developers need to create exciting games with sustainable economies. In the end, the main challenge remains how to create a game that is fun and desirable to play, rewards early adopters for their hard work, and generates enough revenue to fund continued development. Whoever will solve this, and we are confident that someone will eventually, will truly bring benefits and value to the entire ecosystem and reshape the way we see time, value, and community.

Phenomenal article that will strongly influence tokenomic decision making in my project.

👍👍👍