Is STEPN the next Axie?

Part 2: Non-financial utility and in-game spending on net-negative sinks

"After a day's walk, everything has twice its usual value."

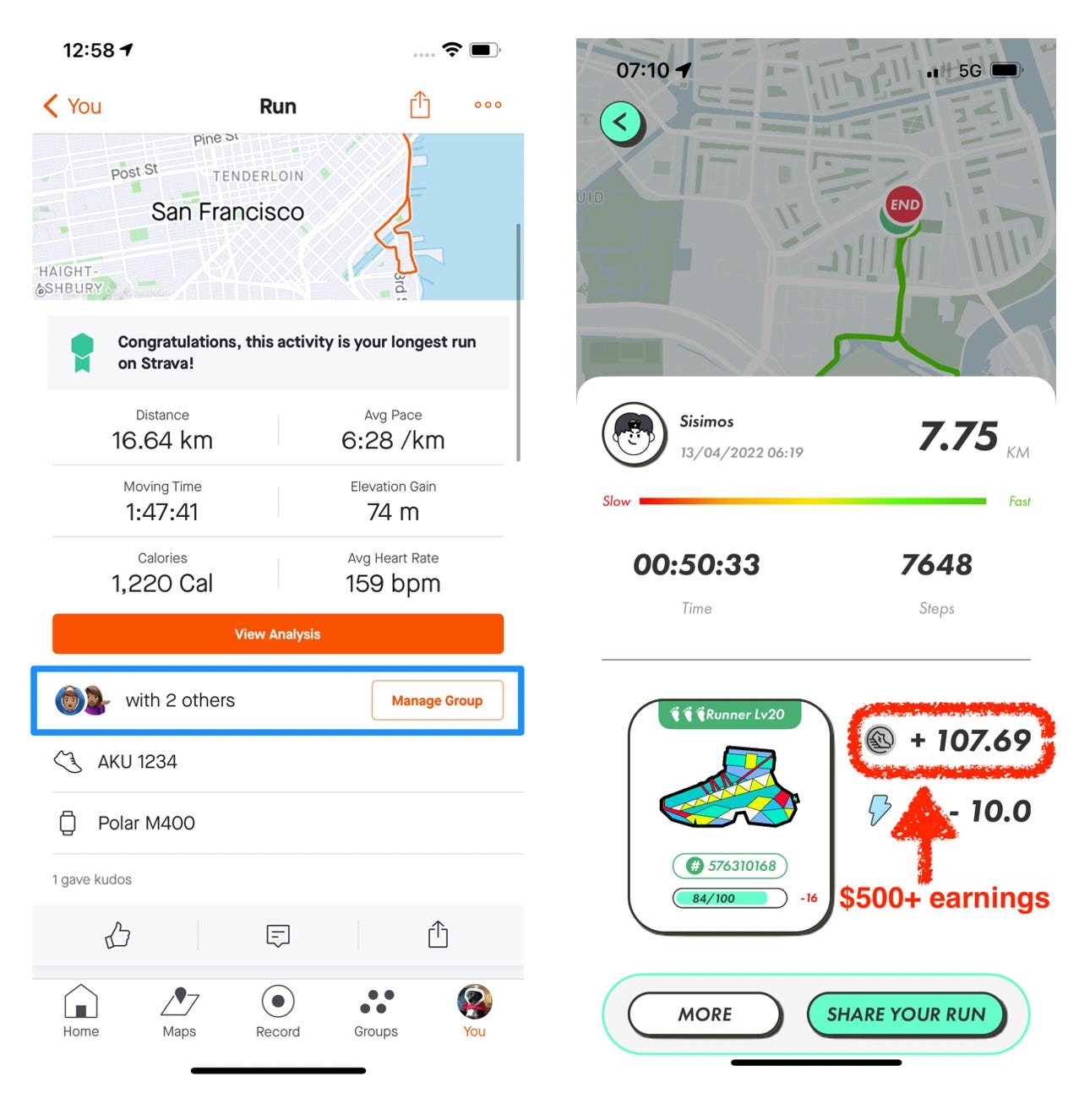

While this 100-year-old quote by G.M. Trevelyan was a metaphor at most, an app called STEPN now promises you to earn significant monetary value by walking. The latest hype in NFT gaming is called “move-to-earn” which allows people around the world to earn crypto by walking or running with a pair of NFT sneakers loaded on a mobile app.

STEPN is the first game to have launched a move-to-earn application and currently is rewarding users with GST token worth around $20-$300 per day to complete short, daily walks.

The project which calls itself “a Web3 lifestyle app with inbuilt Game-Fi and Social-Fi elements” has also launched its native GMT token which reached a fully-diluted market capitalization of over $13bn (!).

To put things into context, this makes STEPN’s 1 month-old ecosystem token more valuable than the below companies:

The enormously high earnings potential coupled with high user growth should ring the game economy sustainability alarm bells.

But in their latest blog post, STEPN claims to have “learned valuable lessons from the mistakes of play-to-earn games” like Axie Infinity and have solved the hyperinflation challenge for their uncapped GST token by incentivising reinvesting of earnings into sinks that allow for future earnings opportunities instead of cashing out earnings.

Picking up on our previous article on the success factors of NFT-based games, we evaluate if this approach can save STEPN’s game economy or whether STEPN is the next P2E economy prone to collapse.

Is STEPN sustainable?

In Part 1 on open game economies, we explained why game developers need to focus on creating exciting games with sustainable economies to be successful.

For open game economies to be sustainable,

there must be pure demand for the game’s entertainment component from players and external stakeholders which is not tied solely to earning expectations

the game must be able to monetize this demand in the form of in-game spending on deflationary burning mechanisms (sinks) that retain value in the ecosystem and remove assets from the economy

the production of game asset supply (faucets) must scale sustainably alongside increased demand for deflationary sinks to maintain desired price levels

Let’s use this framework to evaluate the long-term viability of STEPN’s “move-to-earn” model.

1) Is there pure demand for the game?

STEPN’s core game loop is building up daily walking/running activity in exchange for token rewards which has the potential to excite a large community of walkers and runners.

The early gamification movement in programs like Nike+ focused on social aspects around achievements and apps like Strava have allowed users to share billions of activities to date.

It’s not surprising to see demand for a form of extrinsic motivation to exercise but in the case of STEPN, the social aspect seems to be focused on comparing your yield and sneaker NFTs.

The difference with STEPN is that Strava or Nike+ can

be accessed for free (instead of having to buy NFT sneakers at a floor price of around $1k at the time of writing) and

is being used out of pure demand for entertainment and social sharing of achievements (instead of the expectations of earning rewards)

The best way to assess the pure player demand of a game is to evaluate if players would still be willing to spend time and money in the game even if there was no earnings potential for them.

STEPN itself has no form of gameplay in the traditional sense. The focus of all the elements is around optimizing reward yield with walking/running being a requirement for obtaining that yield. Some elements like upgrading, gem socketing, and mystery boxes hint at the idea of creating actual gameplay albeit that is only gamification of earnings optimization.

Therefore, it is highly unlikely that STEPN, in its current form, has pure player demand for any game utility other than ROI. While there are most likely people out there who would consider spending money to upgrade a virtual sneaker NFT just to flex, this community would be significantly smaller than the number of people currently using STEPN purely to earn GST rewards.

It appears that STEPN is aware of this issue. In the blog, they claim they are working on “making sure to design its app to be addicting, rewarding, and fun even beyond earning crypto” but there is no mention of any specific plans for what this would be. It will be challenging to achieve this in time before better opportunities appear for ROI-chasers.

As the majority of demand for STEPN game comes from expectations of earnings rather than from enjoying the gameplay, users are

less likely to spend for entertainment in-game and

more likely to switch to other games with higher earnings opportunities swiftly once the GST ROI drops in real terms.

This can lead to a fast collapse of the STEPN game economy.

2) Is there in-game spending and is it leading to inflation?

As a general rule in the long run, sustainable economies cannot pay out (mint) more rewards to players than the value that is brought into the game from players via in-game spending.

The in-game spending must be at least partially on deflationary sinks that take assets out of the economy (burn) at a rate that balances out production.

Most transactions in the STEPN ecosystem are not happening on-chain and key sustainability metrics are not disclosed by STEPN yet.

The current APY% on STEPN NFTs is over 1000% which is a payback period of just over one month and the user number in the STEPN ecosystem has just surpassed 200k users with minimum one sneaker. Based on these enormous returns and the rapid user growth, we can assume that the daily number of GST rewards being minted in STEPN is high and increasing at a fast rate.1

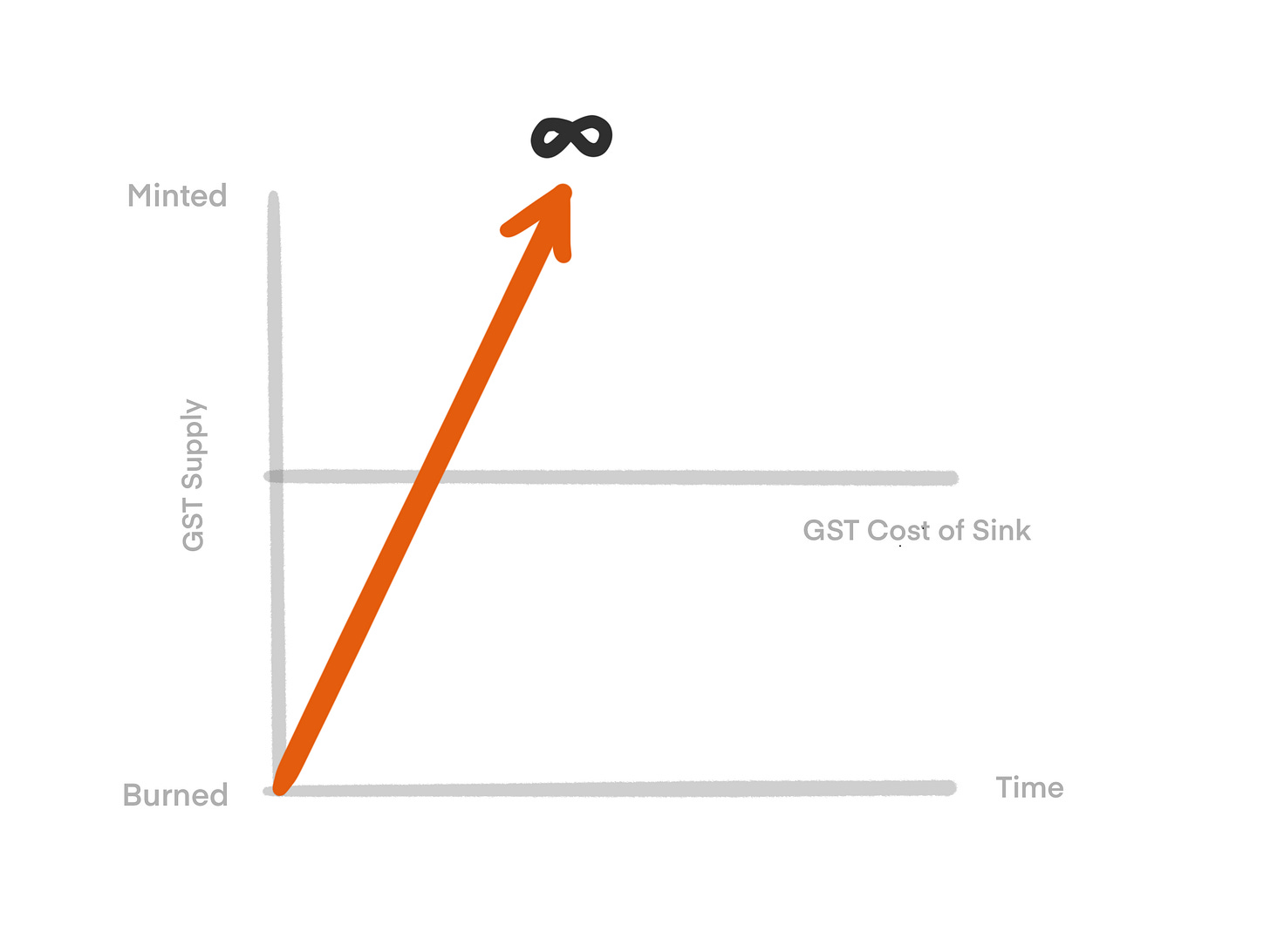

To keep the value of reward “payouts” stable, GST needs to be sunk/burned at least at the rate equal to the amount of GST rewards that are payed out or minted. Otherwise, GST supply eventually outpaces demand and the value of the token drops.

In their blog, STEPN points out that they have solved Axie’s hyperinflation issue and what sets their economy apart from them is that they incentivise their users to reinvest their earnings into the game (vs. Axie where players are mainly selling their SLP earnings into fiat).

Unfortunately, this explanation is 1) misleading and 2) missing the point about what matters what matters for sustainable game economies:

STEPN’s sustainability issue is that there is no utility other than ROI and therefore no significant in-game spending on deflationary sinks to burn GST tokens LONG-TERM.

The only sinks currently available in STEPN are ROI-related and net-positive which means they take GST out of circulation short-term but only to allow for more production of GST medium-term. So regardless of the fact that STEPN users retain their GST rewards in the economy rather than cashing out, most of the of this value is currently re-invested & burnt with to goal of increasing future ROI.

As we have seen with Axie and Pegaxy, this type of reinvesting/spending delays the increase of the reward token mint/burn ratio but will eventually lead to hyperinflation once new user growth slows and rewards are being sold rather than re-invested into reward-generating sinks.

Even though it has not been mentioned in any of STEPN’s blogs as a possible solution to combat inflation, STEPN plans to introduce some net-negative (deflationary) sinks like sneaker customization (cosmetics) that could possibly balance out excessive GST production. According to the latest blog, STEPN‘s developers seem to believe that a desire for carbon offset credits as a net negative sink will be effective, but it’s likely to be a mismatch with the majority of their active audience.2

As with any P2E game which has limited gameplay and is mainly centered around earnings, it is questionable whether

the game’s devs can ship the net-negative sinks in-time before hyperinflation breaks out

cosmetics and other net-negative sinks will actually be desirable, once launched, as most players are grinding for the earnings and have no demand for non-ROI related spending like cosmetics

Beyond a whitepaper full of buzzwords and a strong, earnings-focused community, STEPN lacks any meaningful gameplay or non-financial game-typical utility like fun, distraction or social factors which could attract non-ROI-related, in-game spending (e.g. cosmetics) to reduce the token supply. STEPN’s social media is full of examples that show that show the shared purpose of the STEPN community which is entirely based on maximizing yield efficiency.

Therefore, it is very likely that there will not be enough in-game spending on net-negative sinks, if they even launch in time, to offset the enormous future GST supply increase and prevent hyperinflation.

3) Will the economy grow sustainably?

When a play-to-earn scheme has no net-negative (deflationary) sinks, the issuance of reward-producing NFTs (sneakers in STEPN’s case) must be strictly controlled and sustainably scaled alongside growth in order to prevent hyperinflation. If production of assets is not either capped or balanced out by sinks then it will by definition be inflationary and the assets will lose value in real terms.

In the case of STEPN,

there is no limit to the amount of sneaker NFTs that can be minted (e.g. less breeding restrictions than in Axie)

NFTs produce unlimited GST tokens in perpetuity (only minor daily energy production caps which can be circumvented by upgrading/repairing)

there is no skill-based or competition-based distribution of rewards (everyone can earn)

STEPN is currently in a semi-closed beta environment but plans to introduce the asset lending which will attract speculators and guilds. The only real bottleneck to minting continuing to increase inflation, is limitations on activation codes as NFT supply will always be matched by unconstrained minting.

Takeaways

While the idea of connecting people through movement is an honourable one, STEPN’s economic design is full of red flags for sustainability and will most likely lead to a collapse of STEPN’s native assets once the growth of new capital inflow slows and fails to scale with the exponentially increasing earnings which need to be financed by new players. There is currently no justification for STEPN’s market capitalisation compared to companies like Puma, Lufthansa and Peloton.

STEPN currently has no utility or appeal other than the ability to earn high rewards and the game’s economic design will only be able to delay the imminent inflation through its heavy re-investment incentives for a certain time.

The developers misleading marketing message will make some early investors wealthy but will lead to an inevitable collapse and losses for a lot of late entrants once the music stops. Having some meaningful gameplay to sustain interest beyond ROI would go a long way towards making STEPN a more sustainable product.

For the NFT gaming space to succeed, we need to evolve from ponzinomics schemes without gameplay to exciting games which attract pure players to sustainable economies.

Transparency about the risks and the right metrics is essential for this space to mature and weed out bad actors. In the upcoming blogs, we will focus on exciting new projects which are addressing tokenomics sustainability challenges in the right way.

It’s important to note that although the game promises “earning” from exercise, the actual real world earnings come from other players, not the STEPN developers. While STEPN promises consistent earnings they are simply in the form of the GST token who’s actual value is determined by what other players are willing to pay for it. If you consider the upgrade system a form of earning then that is provided by STEPN, but that is not what “earn” means in web3 nomenclature.

One element of gems upgrading can technically be a net-negative (deflationary) sink as they have a GST-denominated cost but can randomly lead to outcomes with no GST payouts (failed upgrade). There is no data on the actual usage of this sink and how much they statistically burn or mint. Nonetheless, if upgrading gems lead to statistically high chances of “no payouts” because upgrades fail too often, they are less likely to be used and less GST will be sunk in a net-negative way. Overall, this potentially deflationary sink is not enough to offset the endless increase of supply via the other net positive sinks.

Try playing the game, it’s very addicting and encouraging people to get outside and move, (people who normally wouldn’t) Strava and Nike+ are not enticing anyone outside of the running/ exercise community to join them. Although I don’t think you will be earning $1000/day a year from now $50/day will still motivate people to move.

There are a few sinks on the way, at least according to their roadmap. For example marathons where users have to pay GST to participate. If they can continue to build the community then there is a chance people will stay for the intrinsic social value and not just the APY. I think there is a lot of potential but the question is whether they can ship negative sinks fast enough. They are in a race against the clock. It is going to be interesting to see who wins.